About Us

Our History

Our Staff

Chloe Miller, Administrator

Chloe joined the Chamber in December 2023.

Who We Are

Chamber Chatter E-news

2024-2025 Board of Directors

Member spotlight, July 30, 2019: Our member spotlight this week is shining on Harrison's Pro Tree Service LLC. Harrison's Pro Tree Service LLC was started by Jeff Harrison in 2008 with little money and only a pick up truck and trailer. Jeff had high hopes for the future and has worked extremely hard to get where he and his wife are today. His wife, Denise Harrison, joined the team in September of 2008 as a groundman while attending Miami University as a Biology Major. Soon after graduating from Miami University in December of 2013 she became a Certified Arborist and is now their full-time Sales, Networking, and Marketing Specialist. Jeff has over 30 years experience in the Tree Care Industry and continues running our crews on daily basis.

Harrison's Pro Tree is located in Franklin, OH, and currently offers the highest quality Tree Trimming, Tree Removal, and Stump Grinding services in our area. "We take Pride that we have a 5-Star Rating on Google and have hundreds of reviews online. We are fully OSHA-compliant and train our crews on a weekly basis." The company that started with only 1 truck and trailer now has a fleet of 6 trucks and 10 employees. The company continues to grow each and every year. The company is also highly involved with various organizations. Denise is our Vice President/President-elect at the Franklin Area Chamber of Commerce. She holds a Board of Directors' seat for the Greater Dayton Apartment Association, volunteers with the Rent Foundation, and volunteers on various committees for both the Greater Dayton Apartment Association and the Greater Cincinnati Northern Kentucky Apartment Association. The company is also a member of the BBB, Angie's List, Tree Care Industry Association, International Society of Arboriculture, Community Associations Institute, and the Southwest Safety Council. Harrison's Pro Tree also sponsors local sport and school programs each year. "We take Pride in our Community and are always looking for ways to give back!"

"Our Mission is to provide our customers with the highest quality tree service while providing professionalism from start to finish. Our goal is to offer you a service that is both hassle- free and top quality. We pay careful attention to detail from beginning to end to ensure your complete satisfaction. We are aware that we work in residential neighborhoods as well as commercial places of business and promise that everyone and each and every place is respected. To ensure that you are provided with the highest quality of work in the safest manner, we educate and train our employees." Jeff and Denise Harrison have a total of 40 years combined experience and take great pride in a reputation of providing the highest quality work in the Miami Valley Area. "We hold high expectations for our crew in order to provide a safe work environment for both our employees and customers. Harrison's Pro Tree Service looks forward to working with you and building a relationship. Give us a call at 937-974-6891 Today for your Free Estimate!"

Member spotlight, July 15, 2019: Our chamber member spotlight is shining this week on Atrium Medical Center. Atrium (www.atriummedcenter.org) is Warren County’s only full-service hospital and Level III Trauma Center. This month, the hospital unveiled an upgraded tumor-fighting linear accelerator to deliver radiation treatment more efficiently and to reduce side effects in patients. Linear accelerators produce a range of very high energy radiation beams that are directed to deliver radiation dose to the tumor inside the body. Atrium’s new linear accelerator features high resolution CT imaging, robotics, and rapid dose delivery. Ryan Steinmetz, MD, medical director of Premier Health’s radiation oncology program, explained that the new linear accelerators decrease treatment time for patients, as well as allow for more accurate treatments, which can improve cure rates and decrease complications. “Premier Health and Dayton Physicians Network, through our partnership, are committed to providing high-quality cancer care close to the healing comfort of home,” Dr. Steinmetz said. Atrium’s new linear accelerator “enables us to target cancer with pinpoint accuracy and avoid normal tissues. This means patients are treated with better cancer-fighting abilities and less side effects,” Dr. Steinmetz said. The new radiation oncology technology began use July 9 at Atrium.

Member spotlight, June 4, 2019: Our chamber member spotlight this week is shining on Peoples Bank. Peoples Bank has been in business since 1902 and has established a heritage of financial stability, growth, and community impact for more than 115 years. Peoples makes available a complete line of banking, investment, insurance, and trust solutions, and the Peoples Bank Foundation provides resources to meet the needs and challenges of all segments of the community. “Peoples is dedicated to making a positive and meaningful difference in the neighborhoods where we work and live,” said Franklin Branch Manager Jackie Frederick. “We’re not just from the community – we’re for the community.” Peoples Bank has two offices in the Chamber’s footprint. Please give us a call – our associates are here to help. Working Together. Building Success.

Franklin

1400 E 2nd Street

Jackie Frederick, Branch Manager

937.283.3168

Jacqueline.Frederick@pebo.com

Carlisle

655 Central Avenue

Stephanie Spatz, Branch Manager

937.743.2037

Stephanie.Spatz@pebo.com

Member spotlight, May 28, 2019: Our chamber member spotlight is shining this week on Jones Warner Consultants, Inc. JWCI. The Jones Warner Consultants, Inc., aka JWCI was founded in 1994 by James S. Jones, P.E. and Richard Warner, P.E. as a full-service consulting/engineering company providing professional services and ethical personal relationships primarily to the public client. Originally located in Centerville, Ohio, JWCI relocated their principle place of business to Franklin in 2007. Since that time JWCI has expanded their surveying and design services and opened two additional offices in Cincinnati and Southeast Ohio. JWCI provides both survey and design for various types of public projects in Southwest Ohio, Northern Kentucky, and Southeast Indiana. Their services include pavement & roadway design, storm sewer collection and detention, sanitary sewer conveyance, lift stations, water distribution and planning efforts. JWCI also works with local developers providing civil site designs and offers other environmental consulting services as well as environmentally friendly “Green” designs with “LEED” certified professionals on staff. President, T. Shawn Campbell, who is also a member of the Franklin Area Chamber Board of Directors, attributes the success of JWCI to their strategic office locations as well as their total team approach with their committed professional staff. “Our employees are our success & relocating our corporate office to Franklin was a calculated move,” said Campbell. “Easy highway access to our service area & in a nice community.” Mr. Campbell was so impressed with the Franklin community, he relocated his residence to Franklin and resides here with his son, Joe, who just finished his third year at the University of Cincinnati. JWCI is located on Claude Thomas Road in the Franklin Business Square.

Member spotlight, May 13, 2019: Our chamber member spotlight this week is shining on Franklin Self Storage. Franklin Self Storage, 306 Conover Dr., is located near I-75 and St. Rt. 73. They offer month-to-month leases with no long-term obligation. They provide safe, affordable storage for furniture, household treasures, documents, and other items, in a clean, paved, conveniently located facility. Their hours are 9 to 5, M-F, and 9 to 1 on Saturdays; call them at (937) 746-5190 to speak to the friendly, professional staff members, Holly Dean and Dave Harwood. Franklin Self Storage also finds many ways to give back to the community. They are long-term supporters of the Chamber, the Franklin Area Historical Society, the school district, and many other organizations, and are truly a community asset!

Member spotlight, May 6, 2019: Today we're highlighting Schmidt Auto Care. Erich Schmidt opened his shop at the corner of 6th and River Sts. in Franklin in 2009 and he joined our chamber shortly thereafter. Initially, all Erich wanted to do was to help people get back on the road safely. He had no intention of the business growing into what it has become and says that there are days when it all feel surreal. Schmidt launched their savviest auto shop location yet in late 2018 on Hiawatha Trail. It has state-of-the-art equipment and oodles of client-care factors. Their lead ASE technicians are well-versed in their skill set, and the client care team is focused on making sure clients leave on a positive note. Schmidt wants you to have an automotive experience, not just another trip to a garage. They accept all makes and models are now accepting new Fleet Accounts that can be fully customized to your business’s needs. They give back to the community with involvement in the Wounded Warrior Foundation, by sponsoring surrounding schools’ functions and sports events, by donating to local food pantries, and by hosting complimentary car classes thru the year for local drivers. Clients can download their free mobile app – Schmidtautocare – to keep history, discounts, and scheduling at their fingertips. They also offer clients a digital inspection that can be emailed or texted for visual education on their repair. These two programs allow their clients easy communication and convenience. Their long-term vision includes two additional locations, a skill-based scholarship, and maybe starting some potential spin-off businesses that align with automotive industry. Schmidt says, “The endless support by the Franklin and Springboro communities has been more than we ever dreamed. We would be nothing without the amazing folks inside these communities. From our tiny shop on River to our new production shop on Hiawatha we feel utterly blessed. Blessed to be doing what we love and blessed to serve you all with integrity, excellence, and superior service. Here’s to another 10 years of amazing auto service!” For Fleet Account set up and owner Issues, contact Erich; for advertising, human resources, and sponsorships, contact Lauralee; To book appointments, or for general questions, email call 937-514-7869. Look for Schmidt on Facebook @schmidtautocare and on Instagram @schmidt.auto.care

Member spotlight, April 29, 2019: This week, we're highlighting A Country Peddler. A Country Peddler opened for business in December 2010. The shop specializes in country wares, primitives, furniture, braided rugs, grapevine trees, Billy Jacobs prints and needfuls. A Country Peddler also carries candles and wax melts from Scentsible Scents, Candleberry Co., Warm Glow, and Heart Warming. They're located at 779 Central Avenue, Carlisle and are open Wednesdays, 11-5; Thursdays, 11-6; Fridays, 11-5; and Saturdays, 11-4. The proprietor, Karen Williams, is a graduate of Franklin High School and worked in public relations at NCR Corporation for many years. Karen and her husband, Danny Williams, are Life Members of the Franklin Area Historical Society, Franklin, OH and also decorate one of the mantles at the Harding Museum for the Christmas holidays with items from the shop. For more information, check out their Facebook page: https://www.facebook.com/acountrypeddler/

Resources to assist you and your organization during the pandemic

The Chamber honors the people and organizations that make our area a great place to live, work, and play. 2024 awards will be given at our 2024 annual meeting, date TBD. Nominations are accepted all year and due May 24, 2024.

Our Sustaining Members

Area Attractions

Dining

Downtown Franklin Farmers Market

Historic Sites

Past Winners

Carlisle Local Schools

City Events

City History

About the Township

Franklin City Schools

City of Carlisle

Member-To-Member Discounts

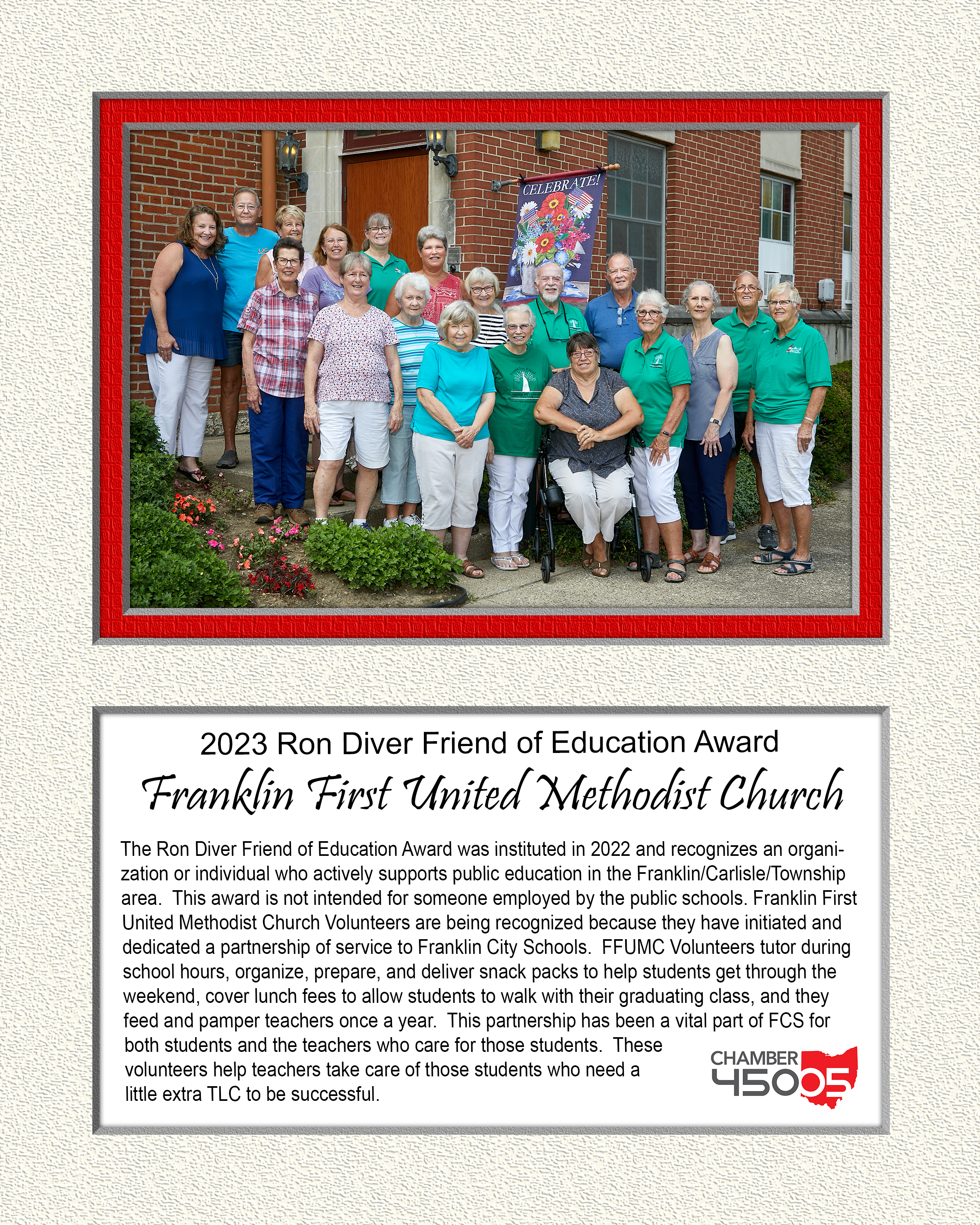

2023 Awards

We will be adding to these frequently.

We'd love to stay in touch: Please join our mailing list.

Shuttered venue operators grant: The U.S. Small Business Administration (SBA) officially opened its Shuttered Venue Operators Grants program. If you are an operator of a live venue, live performing arts organizations, museums, and movie theatres, as well as live venue promoters, or theatrical producers and talent representatives, you can apply for economic assistance. Applications are being accepted on a first-come, first-serve basis. The portal for submitting applications is live and can be found here: https://www.svograntportal.sba.gov/s/

Mission Statement: In partnership with the family and community, the Carlisle Local School District mission is to focus on the needs of students in everything we do, while providing quality educational experiences in a positive, innovative and safe learning environment.

The City sponsors events throughout the year.

Franklin was founded in 1796 by General William C. Schenck and named for Benjamin Franklin. The city occupies 8.1 square miles in northwest corner of Warren County in southwest Ohio. Franklin is home to approximately 12,000 residents, and is one of the cities in the fasting-growing Cincinnati-Dayton-Springfield corridor.

The city hugs the Great Miami River, which contributed to its history as a paper manufacturer center. Today, Franklin's industrial base is more diversified, thanks to its position along Interstate 75, easy access to other major transportation arteries and the diligence of the City Council, Mayor, and Chamber of Commerce.

Franklin was incorporated in 1814 and assumed city status in 1951. The city operates under a council-manager form of government, with seven at-large council members elected on a non-partisan basis to four-year terms. The council elects one of its members as mayor.

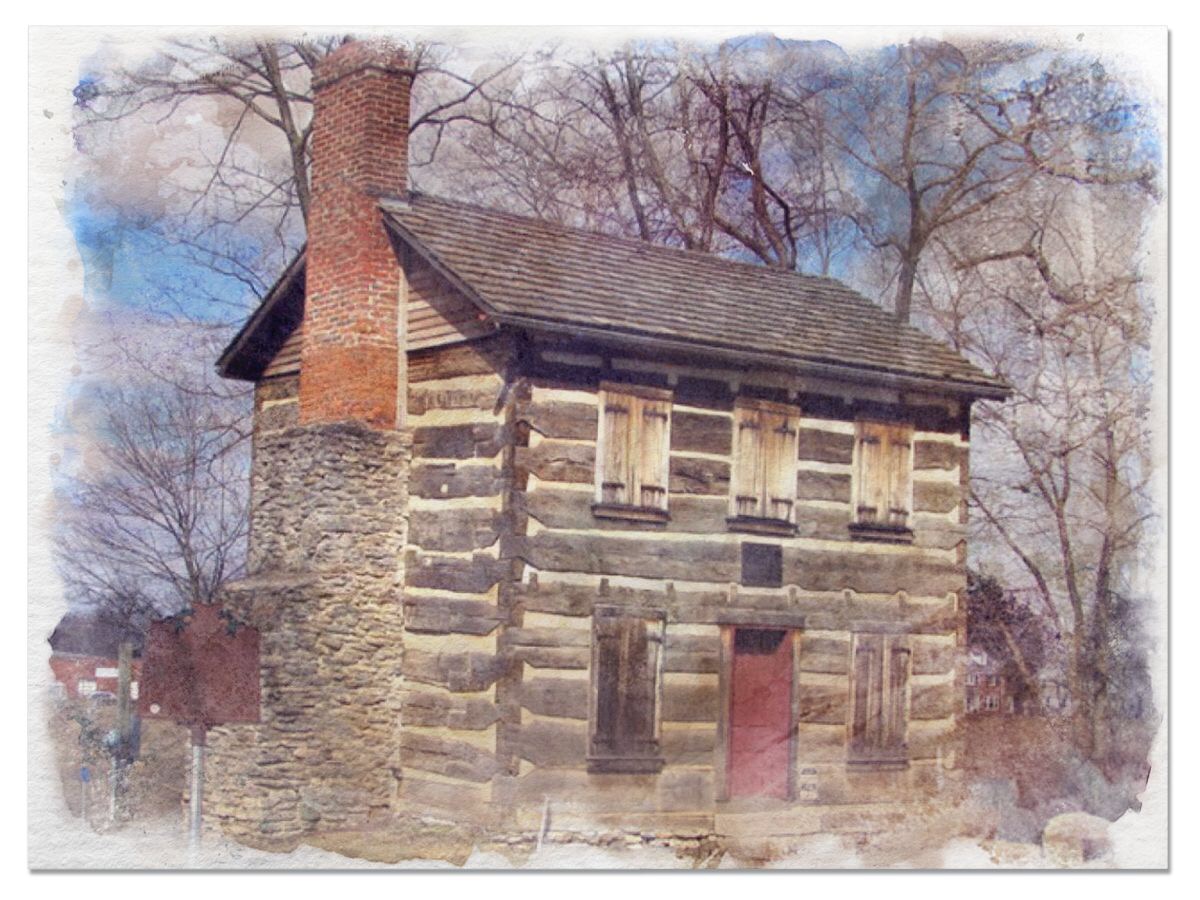

Franklin had one of the first four post offices in Warren County. It was established in 1805. Thomas Jefferson appointed the first post master, John. N.C. Schenck, brother of William C. Schenck. The first post office was in his home. This log cabin, now located on River Street, was entered into the National Register of historic places in 1976.

Franklin is proud of the full array of services it offers residents. A full-time workforce provides police, public works, street maintenance, building inspection, fire, and parks and recreation programming.

The city website has a more detailed history.

Read a blog by the Warren County CVB about Franklin.

FCS is a 3,000-student district that operates five elementary buildings, a middle school, and high school. Voters passed a bond issue that will allow the district to completely rebuild or renovate all of its buildings. The new high school is scheduled to open in January 2024.

The district offers a variety of programs that fit the needs of all students.

Franklin High School offers Honors classes, Advanced Placement Courses, and College Credit Plus courses with Sinclair Community College and Cincinnati State.

Information about enrollment procedures, buildings, programs, and more are available on the district website.

The Village of Carlisle, Ohio is a municipality of approximately 5,000 people, located in the Dayton-Cincinnati metropolitan area. Carlisle is home to an excellent school system, a diverse commercial and industrial base, and a strong, family-oriented community.

From the near-constant presence of trains, calling back to its days as a railroad town, to its roots as a rural, agricultural community, it is evident that Carlisle has a long history, rich in both culture and commerce — a history that we are eager to extend into the twenty-first century.

If you are drawn here by the assurance of educational excellence, the lure of small-town charm, or the promise of industrial success, we are confident that you will find what you are looking for. Whether you hope to start & raise a family, enjoy a friendly community with a quiet, rural atmosphere, or take your business endeavors to the next level, Carlisle is the place for you. Welcome home!

| Officers: | ||

| President | Jen Crosby, BHHS Professional Realty | |

| Members at large: | ||

| Christine Pirot | Premier Health Atrium Medical Center Foundation | |

| Kim Gates | Warren County Career Center | |

| Chip Denlinger | DCS Technologies | |

| Josh Meyers | Edward Jones | |

| Tom Wiggershaus | WesBanco | |

| Sara Weir | Atlas Roofing |

| Permanent Seats: | ||

| Dr. Mike Sander | Superintendent, Franklin City Schools | |

| Bob Fischer | Superintendent, Carlisle Local Schools | |

| Jonathan Westendorf/ Khristi Dunn | City Manager / Clerk of Council, City of Franklin | |

| Darryl Cordrey | Administrator, Franklin Township | |

| Chris Lohr | City Manager, City of Carlisle |

Chamber45005 (formerly The Franklin Area Chamber of Commerce) was founded in 1947 to encourage growth of the city and employment opportunities for its residents. Larry Rossman was the first Chamber president. After the town became a city, the Chamber sponsored and paid for the first master plan for the city.

The Chamber was involved with industrial development from the early 1950s and began working to bring industries to town. In the 1960s, the Chamber purchased and developed an industrial area on North Main Street. In the 1970s, the Chamber worked on the annexation and development of the Jaygee Industrial Park.

Today, our 200 members include businesses, individuals, and organizations from Franklin, Carlisle, Springboro, Middletown, and many other surrounding communities.

We work to be the voice of the business community and a voice for the business community as well.

Being a sustaining member is a great way to get noticed and to get your organization's name in front of potential customers and clients.

Become a sustaining member by sponsoring an event such as a luncheon, the annual meeting, our holiday lunch, and after-hours event, or our golf outing.

The Chamber thanks its 2023 sustaining members for their support!

Diamond member: City of Franklin, Duke Energy

Platinum members: Premier Health Atrium Medical Center, Rod Litteral/First Realty Group, Joy Patrick/Patrick Staffing, and Franklin Township

Gold members: WesBanco, Pfizer, and Risk Strategies, PuroClean Emergency Services, Land of Illusion

Silver members: Anderson Funeral Homes, Patriot Manufacturing Group, Bob's Moraine Trucking, Vinnie+Velvet

Bronze members: A Country Peddler; Conger Construction Group; Edward Jones — Josh Meyers; Friends of Scott Lipps; Greenpoint Metals; Harrison's Pro Tree Service LLC; Jen Crosby--Berkshire Hathaway HomeServices Professional Realty; Jones Warner Consultants Inc.; Lake Erie Electric; Peoples Bank; Pfizer; Ruppert, Bronson, and Ruppert; Schmidt Auto Care; Simpkins Foley Insurance Associates; Unifirst Corp.; Wade Insurance; Warren County ESC.

110% Club: A Country Peddler; A&G Pizza; Allstates Termite and Pest Control; Amerifirst Mortgage; Area Progress Council/Project Excellence; Architectural Reclamation; Area Athletics; Black and Chrome Trucking; Bob's Moraine Trucking; Bond Machine; Carlisle Auto and Tire; Conger Construction; D Johnson Electric; DQ Carlisle; Dayton Dragons Professional Baseball; Dry Patrol; Josh Meyers--Edward Jones; Estes Oil; The Farm on Central; First Realty Group; Franklin Cabinet; Franklin Township; Franklin Ridge Healthcare Center; Franklin-Springboro Public Library; Franklin License Bureau; General Engine Products; GoKeyless; Good Industries (Franklin Operations); Greenpoint Metals; Gross Lumber; GTCO; H&W Screw Products; Harrison's Pro Tree; Homecare Mattress; Huhtamaki; Insurance Associates; IT2; Jen Crosby, Berkshire Hathaway HomeServices Professional Realty; Jones Warner; Kaup Mulligan Law; Knox Machinery; Lake Erie Electric; Liquid Manufacturing Solutions; Malhotra Real Estate; Middletown Community Foundation; Mears Insurance; MES Services; Mid-Towne Auto; Miracle Welding; Modula; Museum of Spiritual Art; Patriot Manufacturing Group; Peoples Bank; Pfizer; Pietra Naturale; Preveiling Touch; Queen's Auto Service; Radmedix; Restaurant Parts and More; Richards Monument; Riverview Packaging; Robin Patrick; Ruppert, Johnson, and Ruppert; Schmidt Auto Care; Simpkins-Foley Insurance Associates; Superior Equipment; Touching Hearts at Home; Trio Hair; Unifirst; Wade; Waxco International; Warren County Foundation; We Love Cookies; WYCO Consulting; and Zink Market.

2023 Sponsorships:

Chamber annual meeting (July): Franklin Township

Chamber December holiday luncheon: Franklin Township

We're located in Warren County in SW Ohio and primarily serve the 45005 zip code, which is the City of Franklin, City of Carlisle, and Franklin Township, and we have members from as far away as Cleveland.

Our focus is to support businesses by helping them make connections, get noticed, and save money. We offer networking events and tangible benefits such as discounts for healthcare and workers comp group rating plans.

The Chamber works to enhance workforce skills through cooperative efforts with local school districts and higher education, encourages the arts and education, seeks to ensure open dialogue with government leaders, and to add to our community's quality of life.

Chamber members have fun too, socializing at our after hours events, the Annual Meeting, and Golf Scramble.

Our e-newsletter keeps members informed about Chamber happenings and member news.

Join us today and meet active, caring people in our community!

A&G Pizza, 44 Millard Dr. Pizza with the thin crust popular in SW Ohio! Sandwiches, salads. Beer. Eat-in, carry out, delivery. (937) 746-2869.

JD Legends, 65 Millard Dr., Full-service restaurant and bar, entertainment complex, concert venue. Ohio’s largest outdoor tiki bar. (937) 746-4950.

Dairy Queen Carlisle, 490 Central Ave, Carlisle. Burgers, fries, soft-serve ice cream, and signature shakes. (937) 743-2700.

Museums & History

Log Post Office—River & Fifth Street. Commissioned by Thomas Jefferson, the original log structure housed the first post office in the area. Right on the bike path at River and Fifth Streets. Drinking fountain and benches. Call 937-746-8295 for tours. Currently closed for repairs.

Harding Museum—302 Park Avenue, Franklin. Home of WWII Gen. Forrest Harding and Judge Justin Harding of the Nuremburg Trials. Extensive collection of military history, period clothing, antiques, and stunning woodwork. Call 937-746-8295 for tours. The Franklin Area Historical Society operates both museums. Open on Fridays year round, 10 a.m. t o 3 p.m., and Saturdays, May through September, 11 a.m. to 3 p.m.

Carlisle Area Historical Society—In January 1984, Richard Van Derveer offered his building at 453 Park Drive, Carlisle, OH to the Carlisle Area Historical Society as a museum. A restoration project began in 1985 to have the museum themed as a “turn of the century” country store. Featuring antique mailboxes, the 1840 Mount Grocery Store counter, a pot-bellied stove, and so much more of Carlisle’s history resides in this remarkable building. Connect with the Carlisle Area Historical Society on Facebook.

The Mackinaw Historic District — West side of the Miami River. Collection of residences on the National Register. The predominant style is Queen Anne, but others include Italianate and Second Empire, Colonial, Georgian, Spanish Revival, Eastlake, Cape Cod, and Bungalow.

Ohio Historical Markers

Franklin and Carlisle have five of Warren County’s Ohio Historical markers.

Mackinaw Historic District — 302 Park Ave., Harding Museum. On the National Register.

Franklin in the Civil War — Woodhill Cemetery, Hamilton-Middletown Rd.

Log Post Office — Great Miami River Park, River St.

Lewis Davis Campbell & Robert Cumming Schenck (Franklin Statesmen) — Great Miami River Park, River St.

Carlisle Station/Schenck-Stanton Rally — Park Drive, Carlisle.

Brochures—If you would like brochures about our area, please contact us.

Franklin's Main St. Murals

Transportation & Bicentennial Murals, 6th and Main Sts. Commissioned for the Ohio Bicentennial, this mural features modes of transportation that were the backbone of Franklin’s success. Includes the only Ohio Bicentennial Mural that's not on a barn.

Veteran’s Memorial Mural, 422 S. Main Street, on the side of VFW Post 7596. A tribute to the Armed Services.

Trompe l’Oeil Mural, Huntington Bank, 4th & Main Sts. A fool-the-eye mural that looks 3D

Delivery Mural, Pisanello’s, 4th & Main Sts. The mural continues inside.

Suspension Bridge Mural, 3rd & Main Sts. The third Roebling suspension bridge was in Franklin, following Cincinnati and Brooklyn.

Old Time Diner Mural, 3rd & Main Sts. Evokes nostalgia for the 1950s.

4th St. Murals

Franklin Street Scene Mural, Franklin Public Library, 4th & Riley. Inside . Familiar Franklin buildings.

Patriotic Mural, American Legion Post 149, 126 E. 4th St.

Water Tower Mural, top of 4th St. hill. One of Franklin's lions is painted on the city water tower.

Millard Drive

Beach mural outside. JD Legends, 65 Millard Dr.

Mural artist: Eric Henn. www.erichennmurals.com

The Chamber has given awards since 1957. Dr. Siegfried was the first Citizen of the Year. The next oldest award is Business of the Year, first awarded in 1970 to Cincinnati Gas and Electric. The President’s Award was added in 1973, Bernie Eichholz was the recipient.

In 1992, 4 more awards were added:

- Industry of the Year. Union Camp was the first recipient.

- Thirkield Award for commercial property renovation was added. Bill Shera was the first recipient.

- Eldridge Award for Historical Preservation. St. Mary Parish was the first recipient.

- Perry Maxwell award for promoting community goodwill: Franklin Square was the first recipient.

In 2022, the Perry Maxwell award was renamed the Eva Louise Polley award.

In 2022, the Ron Diver Friend of Education Award was added.

Awards are given each June at our annual meeting. The nomination window will be open in late spring.

Nominations are open. Deadline for 2024 awards is May 24, 2024.

All past winners through 2023.

Established in 1801, Franklin Township continues to slowly grow while maintaining a large agricultural base. The Township is committed to protecting its boundaries while maintaining a high level of services to its residents.

Home to approximately 29,000 people (12,000 in Franklin, 5,000 in Carlisle, and 12,000 in the unincorporated portions of the township) located between Cincinnati & Dayton, Franklin Township is spread over 33 mi.² of land.

Those who enjoy life at a slower pace will love its many parks and nature preserves as Franklin Township is home to 4 parks with a combined total of over 1,000 acres of sports fields, fishing ponds, horseback riding trails, bird sanctuaries, and more!

Parts of several school systems are included in the township’s parameters: Franklin City Schools, Carlisle Local Schools, Lebanon City Schools, Springboro Community Schools, Middletown City Schools, Bishop Fenwick Catholic school, and Grace Baptist Christian school. Coupled with low taxes, Franklin Township is a very desirable place to call home!

Learn more at the Township website.

Congratulations to our 2023 Award Winners!

Citizen of the Year: Peggy Darragh Jeromos

Industry of the Year: Modula

Business of the Year: Vinnie+Velvet

President's Award: Tom Wiggershaus, WesBanco

Eldridge Award for Historical Preservation: Forever Franklin Downtown Revitalization

Thirkield Award for Commercial Property Renovation: Moore Veterinary Hospital

Eva Polley Award for Community Goodwill: Steve Peters

Ron Diver Friend of Education Award: Representative Scott Lipps and Franklin First United Methodist Church Volunteers

The Downtown Franklin Farmers Market is co-sponsored by the City of Franklin and Chamber45005. Our goal is to help the community "Buy Fresh, Eat Local." The market is held at the Franklin City Building during the summer on Saturdays, 8:30 AM - 12:00 PM. Follow us on Facebook for weekly updates, vendors lists, special events, and more.

We look forward to our 12th season starting on May 24. The last day for the market will be Sept. 13, 2025.

Interested in being a vendor? Click HERE to apply or call the Chamber at 937-746-8457 with questions.

Sponsored by: The City of Franklin & Chamber45005

2022 Awards

Great Miami Riverway: The Great Miami Riverway: 99 miles of river, paved trails, and connected communities in southwest Ohio. Learn more.

Bike Trail: Great Miami Bike Trail The trail is just a block from downtown along the banks of the Great Miami River and passes remnants of the historic hydraulic headgates and dam as well as the historic log cabin post office, amazing murals in downtown and historic homes. It continues 30 miles north into Montgomery County and Dayton MetroParks. www.miamiconservancy.org

Parks: Our area offers an abundance of parks and outdoor recreation spaces.

Bowling & Sand Volleyball: JD Legends and Strike Zone Lanes is in entertainment complex that brings in both national musical acts and local favorites. They offer year-round bowling and 3 outdoor sand volleyball courts amidst the largest outdoor tiki bar and concert venue in the state. (937) 746-4950. www.jdlegends.com

Recipes and articles

This past season, we posted recipes from some of our vendors and volunteers.

Brianna King, Registered Dietitian, Warren County Health District Division of Nursing, kicked off the summer with an article about some great tips for healthy eating. Choose Local Foods at Your Farmers Market! What better way to get involved in your community than by selecting fresh foods from your local farmers market? Eating locally provides a variety of health benefits. Read more.

Strawberry Buttermilk Cornmeal Cake, provided by TresCherie Designs

Joe's Zucchini Pizza, provided by Buddy's Garden

Sugar Cookie Cupcakes, provided by Cravings by Janet

Leek and Potato Soup, provided by Robin Stewart

Congratulations to our 2022 Award Winners!

Citizen of the Year: Charles Anderson

Industry of the Year: Carlisle Local Schools and Franklin City Schools

Business of the Year: Village Station Bar and Grill

President's Award: Tom Isaacs/Warren County ESC

Eldridge Award for Historical Preservation: Justin Rossi and Lucas George

Thirkield Award for Commercial Property Renovation: Rod Litteral

Eva Polley Award for Community Goodwill: Kim Bilbrey

Ron Diver Friend of Education Award: Shoes 4 the Shoeless